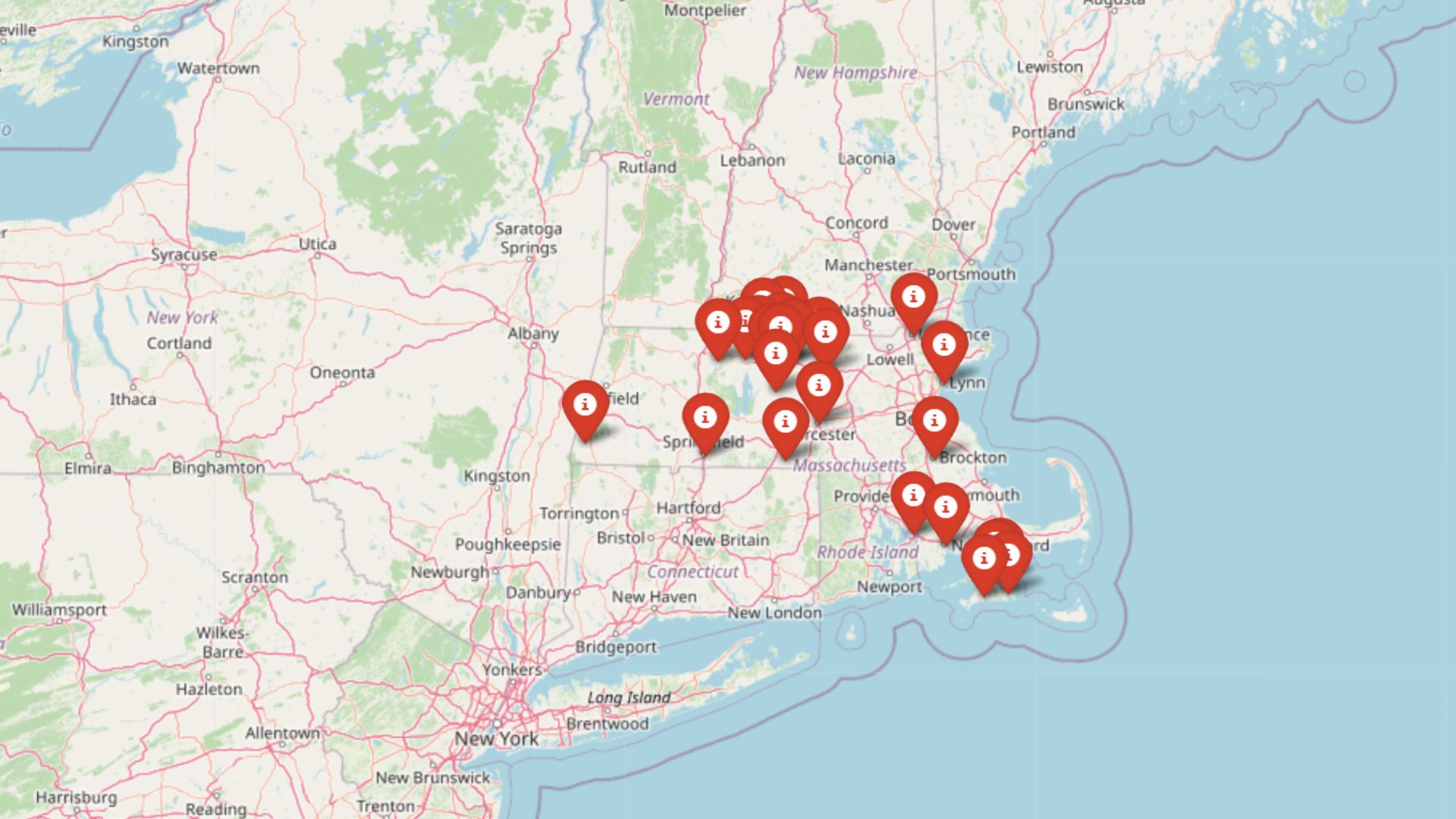

I’ve analyzed the Zillow Home Value Index data to identify Massachusetts towns with the strongest home value appreciation over the past decade. These communities have significantly outperformed the national average, demonstrating remarkable resilience and growth.

While the Boston metro area traditionally captures real estate headlines, these growth stars span from former mill towns to island getaways, revealing a more complex and opportunity-rich landscape across the Commonwealth. Their triple-digit appreciation rates highlight Massachusetts’ enduring market strength.

The percentage increases below reflect extraordinary wealth-building opportunities for homeowners who invested in these communities. These towns represent both established markets experiencing revitalization and emerging destinations capturing new waves of buyer interest.

25. Fall River

- % change from 2016 to 2025: 106.61%

- Home value in 2016: $205,210

- Home value in 2017: $219,328

- Home value in 2018: $231,278

- Home value in 2019: $245,835

- Home value in 2020: $262,862

- Home value in 2021: $304,362

- Home value in 2022: $343,531

- Home value in 2023: $364,146

- Home value in 2024: $394,669

- Home value in 2025: $423,984

Fall River’s astonishing 106.6% value surge has generated over $218,774 in equity for typical homeowners—a financial windfall that would take decades in traditional investments. The post-2020 acceleration (61.3% in just five years) signals the market’s extraordinary momentum amid shifting regional demographics. This historic mill city offers compelling value compared to nearby Boston or Providence, creating a significant arbitrage opportunity for investors. With average values still below $425,000, Fall River presents a rare combination of proven appreciation and remaining upside potential.

24. Barre

- % change from 2016 to 2025: 108.17%

- Home value in 2016: $187,577

- Home value in 2017: $204,569

- Home value in 2018: $218,263

- Home value in 2019: $230,339

- Home value in 2020: $240,989

- Home value in 2021: $275,841

- Home value in 2022: $304,673

- Home value in 2023: $329,686

- Home value in 2024: $363,438

- Home value in 2025: $390,482

Barre’s impressive 108.2% appreciation has transformed $187,577 investments into $390,482 assets, demonstrating extraordinary wealth-building through real estate in this central Massachusetts town. The acceleration since 2020 (62.0% in five years) represents a fundamental market revaluation rather than speculative activity. Despite more than doubling in value, Barre properties remain significantly below state averages, suggesting continued upside potential for investors. With average returns exceeding 8.5% annually (not including rental income), Barre outperforms many alternative investment vehicles. The town’s strategic location offers both rural character and regional accessibility—a combination increasingly valued in post-pandemic markets.

23. Millers Falls

- % change from 2016 to 2025: 108.33%

- Home value in 2016: $140,344

- Home value in 2017: $144,579

- Home value in 2018: $153,785

- Home value in 2019: $160,433

- Home value in 2020: $165,391

- Home value in 2021: $194,541

- Home value in 2022: $220,906

- Home value in 2023: $245,629

- Home value in 2024: $270,261

- Home value in 2025: $292,379

Millers Falls has delivered extraordinary investment returns, with $140,344 properties now commanding $292,379—a 108.3% gain generating $152,035 in pure equity. The remarkable 76.8% surge since 2020 demonstrates accelerating market recognition of this formerly overlooked Western Massachusetts gem. With values still below $300,000, Millers Falls remains accessible despite its explosive growth and offers substantial upside compared to state averages. The village’s strategic location near the Vermont border captures both remote worker migration and regional tourism spending. Recent price trajectory suggests continued momentum rather than a plateau, making Millers Falls a compelling opportunity for investors seeking affordability with proven appreciation.

22. Lynn

- % change from 2016 to 2025: 109.52%

- Home value in 2016: $267,248

- Home value in 2017: $299,826

- Home value in 2018: $332,442

- Home value in 2019: $357,233

- Home value in 2020: $382,430

- Home value in 2021: $434,606

- Home value in 2022: $467,810

- Home value in 2023: $483,507

- Home value in 2024: $525,664

- Home value in 2025: $559,945

Lynn’s remarkable 109.5% appreciation has generated $292,697 in homeowner equity—a wealth-building engine that outperforms most traditional investment vehicles. The early acceleration (24.4% from 2016-2018) indicates Lynn’s growing appeal as a Boston alternative, while post-pandemic value jumps confirm its enduring market strength. Despite more than doubling in value, Lynn properties offer compelling value compared to Boston’s $800,000+ average, creating continued investment potential. The city’s coastal location, transit access, and urban revitalization combine to drive sustainable price appreciation fundamentals. Lynn’s consistent price trajectory demonstrates market conviction rather than speculative volatility.

21. Phillipston

- % change from 2016 to 2025: 109.57%

- Home value in 2016: $195,057

- Home value in 2017: $208,773

- Home value in 2018: $224,099

- Home value in 2019: $232,199

- Home value in 2020: $240,857

- Home value in 2021: $283,575

- Home value in 2022: $314,368

- Home value in 2023: $341,051

- Home value in 2024: $379,530

- Home value in 2025: $408,780

Phillipston’s property market has generated exceptional investment returns, with values surging 109.6% to create $213,724 in homeowner equity—substantial wealth creation through real estate positioning. The extraordinary 69.7% acceleration since 2020 demonstrates this central Massachusetts town’s growing appeal amid shifting work patterns and housing preferences. Despite its impressive performance, Phillipston remains relatively affordable, with prices below many comparable communities, suggesting continued upside potential. The town’s rural character combined with strategic location between employment centers creates sustainable demand fundamentals. Recent price trajectory indicates building market momentum rather than a plateau phase.

20. Egremont

- % change from 2016 to 2025: 113.07%

- Home value in 2016: $356,815

- Home value in 2017: $363,588

- Home value in 2018: $384,295

- Home value in 2019: $405,601

- Home value in 2020: $432,112

- Home value in 2021: $520,583

- Home value in 2022: $624,691

- Home value in 2023: $691,905

- Home value in 2024: $723,576

- Home value in 2025: $760,263

Egremont’s remarkable 113.1% appreciation has transformed $356,815 investments into $760,263 assets, generating $403,448 in equity—extraordinary wealth creation in this Berkshires community. The explosive 76.0% surge since 2020 reflects a fundamental market revaluation driven by urban exodus and second-home demand. While commanding premium prices, Egremont offers significant value compared to $2-3 million properties in neighboring towns like Stockbridge and Lenox. The town’s cultural proximity to Tanglewood, access to outdoor recreation, and historic character create sustainable demand fundamentals. Recent trajectory suggests continued upside despite already substantial appreciation.

19. New Bedford

- % change from 2016 to 2025: 113.25%

- Home value in 2016: $193,967

- Home value in 2017: $209,999

- Home value in 2018: $225,051

- Home value in 2019: $235,828

- Home value in 2020: $252,303

- Home value in 2021: $291,608

- Home value in 2022: $330,055

- Home value in 2023: $351,465

- Home value in 2024: $387,335

- Home value in 2025: $413,640

New Bedford has delivered exceptional financial returns with its 113.3% value surge generating $219,672 in homeowner equity—wealth-building that would require decades in traditional investment vehicles. The remarkable 63.9% acceleration since 2020 demonstrates a fundamental market revaluation of this historic seaport. Despite more than doubling in value, New Bedford properties remain significantly below regional averages, suggesting substantial continued upside potential. The city’s cultural renaissance, working waterfront, and proximity to Boston and Providence create sustainable demand fundamentals. Recent price trajectory indicates building momentum rather than a plateau phase in this revitalized market.

18. Brockton

- % change from 2016 to 2025: 113.49%

- Home value in 2016: $225,228

- Home value in 2017: $250,819

- Home value in 2018: $281,156

- Home value in 2019: $300,815

- Home value in 2020: $323,625

- Home value in 2021: $367,629

- Home value in 2022: $408,069

- Home value in 2023: $427,013

- Home value in 2024: $459,915

- Home value in 2025: $480,844

Brockton’s 113.5% appreciation has generated an impressive $255,616 in homeowner equity—substantial wealth creation that outperforms most traditional investment vehicles. The early acceleration (24.8% in the first two years) indicates Brockton’s early recognition as a Boston alternative, while post-pandemic gains confirm its enduring appeal. Despite more than doubling in value, Brockton properties remain 40-50% below nearby communities, suggesting continued upside potential for investors. The city’s commuter rail access, urban revitalization efforts, and relative affordability create sustainable demand fundamentals. Recent price trajectory demonstrates consistent market conviction rather than speculative volatility.

17. Tisbury

- % change from 2016 to 2025: 113.84%

- Home value in 2016: $581,326

- Home value in 2017: $601,537

- Home value in 2018: $655,884

- Home value in 2019: $710,050

- Home value in 2020: $756,529

- Home value in 2021: $865,609

- Home value in 2022: $1,066,489

- Home value in 2023: $1,156,096

- Home value in 2024: $1,234,725

- Home value in 2025: $1,243,082

Tisbury’s extraordinary 113.8% appreciation has transformed $581,326 properties into $1,243,082 assets, generating $661,756 in equity—remarkable wealth creation through real estate positioning on Martha’s Vineyard. The explosive 64.3% surge since 2020 reflects intensified island demand driven by remote work flexibility and luxury market strength. Despite commanding seven-figure prices, Tisbury offers relative value compared to Edgartown and other premium island locations. The town’s year-round viability, ferry access, and vibrant downtown create sustainable demand fundamentals beyond seasonal patterns. Recent moderation in growth rate suggests a stabilizing market after extraordinary pandemic-era gains.

16. Springfield

- % change from 2016 to 2025: 114.22%

- Home value in 2016: $130,052

- Home value in 2017: $138,680

- Home value in 2018: $149,567

- Home value in 2019: $159,030

- Home value in 2020: $170,487

- Home value in 2021: $200,324

- Home value in 2022: $227,836

- Home value in 2023: $242,122

- Home value in 2024: $262,231

- Home value in 2025: $278,601

Springfield’s remarkable 114.2% appreciation has generated $148,549 in homeowner equity—extraordinary wealth creation that would require decades in traditional investment vehicles. Despite this impressive performance, Springfield remains Massachusetts’ most affordable major city at $278,601, creating exceptional value for first-time buyers and investors. The 63.4% surge since 2020 demonstrates strong market momentum as remote work flexibility expands Springfield’s commuter radius. The city’s higher education presence, healthcare sector, and ongoing urban revitalization create sustainable demand fundamentals. Recent price trajectory suggests continued upside potential in this still-undervalued western Massachusetts market.

15. Leominster

- % change from 2016 to 2025: 114.24%

- Home value in 2016: $207,175

- Home value in 2017: $224,776

- Home value in 2018: $242,724

- Home value in 2019: $255,975

- Home value in 2020: $271,692

- Home value in 2021: $314,795

- Home value in 2022: $349,307

- Home value in 2023: $377,215

- Home value in 2024: $415,231

- Home value in 2025: $443,858

Leominster’s impressive 114.2% appreciation has generated $236,682 in homeowner equity—substantial wealth creation through strategic real estate positioning in this central Massachusetts city. The remarkable 63.4% acceleration since 2020 reflects growing market recognition of Leominster’s value proposition relative to Boston suburbs. Despite more than doubling in value, Leominster properties remain 30-40% below state averages, suggesting continued upside potential for investors. The city’s strategic location, strong manufacturing base, and proximity to outdoor recreation create sustainable demand fundamentals. Recent price trajectory indicates building momentum rather than a plateau in this rapidly appreciating market.

14. Templeton

- % change from 2016 to 2025: 114.60%

- Home value in 2016: $197,031

- Home value in 2017: $210,732

- Home value in 2018: $226,387

- Home value in 2019: $238,265

- Home value in 2020: $252,876

- Home value in 2021: $297,959

- Home value in 2022: $337,466

- Home value in 2023: $360,781

- Home value in 2024: $398,703

- Home value in 2025: $422,829

Templeton’s remarkable 114.6% appreciation has transformed $197,031 investments into $422,829 assets, generating $225,798 in equity—wealth creation that far outpaces traditional investment vehicles. The extraordinary 67.2% surge since 2020 demonstrates accelerating market momentum as buyers seek value outside metropolitan areas. Despite this impressive performance, Templeton remains affordable compared to eastern Massachusetts, suggesting continued upside potential. The town’s strategic location near employment centers, rural character, and outdoor recreation access create sustainable demand fundamentals. Recent price trajectory indicates building market conviction rather than speculative volatility.

13. Southbridge

- % change from 2016 to 2025: 114.76%

- Home value in 2016: $168,009

- Home value in 2017: $182,556

- Home value in 2018: $196,232

- Home value in 2019: $205,608

- Home value in 2020: $217,620

- Home value in 2021: $256,047

- Home value in 2022: $290,387

- Home value in 2023: $308,179

- Home value in 2024: $340,278

- Home value in 2025: $360,809

Southbridge’s impressive 114.8% appreciation has generated $192,800 in homeowner equity—substantial wealth creation through real estate in this central Massachusetts town. The remarkable 65.8% acceleration since 2020 demonstrates growing market recognition of Southbridge’s value proposition amid shifting housing preferences. Despite more than doubling in value, Southbridge remains one of Massachusetts’ most affordable markets at $360,809, suggesting continued upside potential. The town’s historic architecture, manufacturing heritage, and strategic location between Worcester and Hartford create sustainable demand fundamentals. Recent price trajectory indicates building momentum in this previously overlooked market.

12. Worcester

- % change from 2016 to 2025: 114.99%

- Home value in 2016: $192,977

- Home value in 2017: $207,053

- Home value in 2018: $227,391

- Home value in 2019: $238,867

- Home value in 2020: $258,017

- Home value in 2021: $300,559

- Home value in 2022: $335,585

- Home value in 2023: $358,388

- Home value in 2024: $394,761

- Home value in 2025: $414,889

Worcester’s extraordinary 115.0% appreciation has generated $221,912 in homeowner equity—remarkable wealth building through strategic real estate positioning in Massachusetts’ second-largest city. The accelerating growth pattern (16.5% from 2016-2018, followed by 60.7% since 2020) demonstrates Worcester’s economic renaissance and growing appeal as a Boston alternative. Despite more than doubling in value, Worcester properties remain 50% below Boston prices, suggesting continued upside potential as migration patterns shift. The city’s higher education cluster, healthcare sector, and commuter rail access create sustainable demand fundamentals. Recent price trajectory confirms Worcester’s transition from undervalued to high-growth market status.

11. West Tisbury

- % change from 2016 to 2025: 115.57%

- Home value in 2016: $732,167

- Home value in 2017: $752,501

- Home value in 2018: $814,568

- Home value in 2019: $883,957

- Home value in 2020: $899,098

- Home value in 2021: $1,037,489

- Home value in 2022: $1,321,136

- Home value in 2023: $1,437,763

- Home value in 2024: $1,549,313

- Home value in 2025: $1,578,344

West Tisbury’s remarkable 115.6% appreciation has transformed $732,167 investments into $1,578,344 assets, generating $846,177 in equity—extraordinary wealth creation through premium Martha’s Vineyard real estate. The explosive 75.5% surge since 2020 demonstrates the pandemic-accelerated luxury market and growing appeal of island properties with substantial acreage. Despite commanding seven-figure values, West Tisbury offers relative value compared to coastal properties in the Hamptons or Nantucket. The town’s privacy, conservation focus, and island lifestyle create sustainable demand drivers among affluent buyers. Recent moderation suggests market stabilization after extraordinary pandemic-era acceleration.

10. Royalston

- % change from 2016 to 2025: 118.08%

- Home value in 2016: $174,154

- Home value in 2017: $187,911

- Home value in 2018: $203,228

- Home value in 2019: $208,690

- Home value in 2020: $227,187

- Home value in 2021: $265,255

- Home value in 2022: $291,227

- Home value in 2023: $308,516

- Home value in 2024: $344,824

- Home value in 2025: $379,795

Royalston’s extraordinary 118.1% appreciation has generated $205,642 in homeowner equity—remarkable wealth building through strategic positioning in this rural Massachusetts town. The 67.2% surge since 2020 reflects accelerating market recognition as remote work flexibility expands viable commuting distances. Despite more than doubling in value, Royalston remains affordable at $379,795, suggesting continued upside potential compared to state averages. The town’s conservation land, outdoor recreation opportunities, and rural character create sustainable demand fundamentals as housing preferences shift. Recent price trajectory indicates building momentum rather than a plateau in this rapidly appreciating market.

9. Baldwinville

- % change from 2016 to 2025: 119.90%

- Home value in 2016: $154,860

- Home value in 2017: $165,575

- Home value in 2018: $181,299

- Home value in 2019: $193,386

- Home value in 2020: $204,837

- Home value in 2021: $241,701

- Home value in 2022: $274,129

- Home value in 2023: $296,074

- Home value in 2024: $322,830

- Home value in 2025: $340,533

Baldwinville has delivered exceptional financial returns with a 119.9% value surge generating $185,673 in homeowner equity—wealth building that would require decades in traditional investment vehicles. The remarkable 66.2% acceleration since 2020 demonstrates growing market recognition of this central Massachusetts village amid shifting housing preferences. Despite more than doubling in value, Baldwinville remains accessible at $340,533, suggesting continued upside potential for investors. The area’s strong manufacturing heritage, outdoor recreation access, and relative affordability create sustainable demand fundamentals. Recent price trajectory indicates building momentum rather than a plateau in this rapidly appreciating market.

8. Oak Bluffs

- % change from 2016 to 2025: 120.01%

- Home value in 2016: $542,094

- Home value in 2017: $576,010

- Home value in 2018: $619,566

- Home value in 2019: $677,391

- Home value in 2020: $707,240

- Home value in 2021: $822,611

- Home value in 2022: $1,003,281

- Home value in 2023: $1,078,373

- Home value in 2024: $1,160,759

- Home value in 2025: $1,192,671

Oak Bluffs’ extraordinary 120.0% appreciation has transformed $542,094 investments into $1,192,671 assets, generating $650,577 in equity—remarkable wealth creation through strategic Martha’s Vineyard positioning. The explosive 68.6% surge since 2020 demonstrates the pandemic-accelerated demand for premium coastal properties with year-round viability. Despite breaking the million-dollar threshold, Oak Bluffs offers relative value compared to other island locations, with continued upside potential. The town’s vibrant character, ferry access, and iconic architecture create sustainable demand fundamentals beyond seasonal patterns. Recent moderation suggests market stabilization after extraordinary pandemic-era acceleration.

7. Winchendon

- % change from 2016 to 2025: 121.33%

- Home value in 2016: $168,297

- Home value in 2017: $181,264

- Home value in 2018: $199,209

- Home value in 2019: $209,533

- Home value in 2020: $224,039

- Home value in 2021: $261,501

- Home value in 2022: $296,938

- Home value in 2023: $317,155

- Home value in 2024: $349,178

- Home value in 2025: $372,483

Winchendon’s remarkable 121.3% appreciation has generated $204,187 in homeowner equity—extraordinary wealth building through strategic real estate positioning in this northern Worcester County town. The impressive 66.3% surge since 2020 demonstrates accelerating market recognition as remote work flexibility expands viable commuting patterns. Despite more than doubling in value, Winchendon remains accessible at $372,483, suggesting continued upside potential compared to state averages. The town’s location near the New Hampshire border, outdoor recreation access, and relative affordability create sustainable demand fundamentals. Recent price trajectory indicates building momentum rather than a plateau in this rapidly appreciating market.

6. Orange

- % change from 2016 to 2025: 122.49%

- Home value in 2016: $134,642

- Home value in 2017: $139,411

- Home value in 2018: $151,117

- Home value in 2019: $163,909

- Home value in 2020: $177,302

- Home value in 2021: $206,915

- Home value in 2022: $238,889

- Home value in 2023: $253,778

- Home value in 2024: $276,594

- Home value in 2025: $299,560

Orange has delivered extraordinary financial returns with a 122.5% value surge generating $164,917 in homeowner equity—wealth building that would require decades in traditional investment vehicles. The remarkable 68.9% acceleration since 2020 demonstrates this western Massachusetts town’s growing appeal amid shifting housing preferences and remote work flexibility. Despite posting one of Massachusetts’ highest appreciation rates, Orange remains the most affordable town on this list at $299,560, creating exceptional value for investors. The town’s historic downtown, outdoor recreation access, and relative affordability create sustainable demand fundamentals. Recent price trajectory confirms Orange’s transition from undervalued to high-growth market status.

5. Edgartown

- % change from 2016 to 2025: 123.66%

- Home value in 2016: $806,644

- Home value in 2017: $857,505

- Home value in 2018: $938,869

- Home value in 2019: $1,023,875

- Home value in 2020: $1,081,539

- Home value in 2021: $1,235,789

- Home value in 2022: $1,577,098

- Home value in 2023: $1,722,188

- Home value in 2024: $1,793,101

- Home value in 2025: $1,804,159

Edgartown’s extraordinary 123.7% appreciation has transformed $806,644 investments into $1,804,159 assets, generating $997,515 in equity—remarkable wealth creation through premium Martha’s Vineyard real estate. The explosive 66.8% surge since 2020 demonstrates the pandemic-accelerated luxury market and the island’s growing appeal among affluent buyers seeking both investment and lifestyle benefits. Though commanding the highest average value on this list, Edgartown’s prestigious address and limited inventory support continued price stability. The town’s historic character, harbor access, and exclusivity create sustainable demand among high-net-worth individuals. Recent moderation suggests market stabilization after extraordinary pandemic-era acceleration.

4. Gardner

- % change from 2016 to 2025: 126.67%

- Home value in 2016: $157,245

- Home value in 2017: $170,055

- Home value in 2018: $185,100

- Home value in 2019: $193,993

- Home value in 2020: $208,832

- Home value in 2021: $246,441

- Home value in 2022: $278,893

- Home value in 2023: $299,287

- Home value in 2024: $333,078

- Home value in 2025: $356,429

Gardner’s remarkable 126.7% appreciation has generated $199,184 in homeowner equity—extraordinary wealth building through strategic real estate positioning in this central Massachusetts city. The impressive 70.7% surge since 2020 demonstrates accelerating market recognition of Gardner’s value proposition amid shifting housing preferences. Despite more than doubling in value, Gardner remains significantly below state averages at $356,429, suggesting substantial continued upside potential. The city’s manufacturing heritage, higher education presence, and relative affordability create sustainable demand fundamentals for long-term investors. Recent price trajectory indicates building momentum rather than a plateau in this rapidly appreciating market.

3. Fitchburg

- % change from 2016 to 2025: 135.19%

- Home value in 2016: $162,608

- Home value in 2017: $177,482

- Home value in 2018: $196,348

- Home value in 2019: $212,453

- Home value in 2020: $228,450

- Home value in 2021: $264,236

- Home value in 2022: $302,034

- Home value in 2023: $322,272

- Home value in 2024: $361,708

- Home value in 2025: $382,440

Fitchburg’s exceptional 135.2% appreciation has transformed $162,608 investments into $382,440 assets, generating $219,832 in equity—remarkable wealth creation through strategic positioning in this revitalized central Massachusetts city. The extraordinary 67.4% surge since 2020 demonstrates accelerating market recognition of Fitchburg’s value proposition relative to eastern Massachusetts. Despite posting the state’s third-highest appreciation rate, Fitchburg remains affordable compared to Boston suburbs, suggesting continued upside potential. The city’s higher education presence, commuter rail access, and ongoing urban revitalization create sustainable demand fundamentals. Recent price trajectory confirms Fitchburg’s transition from undervalued to high-growth market status.

2. Lawrence

- % change from 2016 to 2025: 136.80%

- Home value in 2016: $197,840

- Home value in 2017: $222,279

- Home value in 2018: $245,484

- Home value in 2019: $267,017

- Home value in 2020: $290,490

- Home value in 2021: $338,131

- Home value in 2022: $378,525

- Home value in 2023: $398,759

- Home value in 2024: $438,967

- Home value in 2025: $468,495

Lawrence’s extraordinary 136.8% appreciation has generated $270,655 in homeowner equity—remarkable wealth building through strategic real estate positioning in this Merrimack Valley city. The impressive early acceleration (24.1% in the first two years) indicates Lawrence’s early recognition as a Boston alternative, while the continued 61.3% surge since 2020 confirms its enduring appeal. Despite more than doubling in value, Lawrence properties remain significantly below neighboring communities, suggesting continued upside potential. The city’s historic architecture, commuter rail access, and ongoing revitalization create sustainable demand fundamentals. Recent price trajectory indicates building momentum in Massachusetts’ second-fastest appreciating market.

1. Athol

- % change from 2016 to 2025: 143.69%

- Home value in 2016: $129,740

- Home value in 2017: $139,538

- Home value in 2018: $153,971

- Home value in 2019: $166,757

- Home value in 2020: $180,299

- Home value in 2021: $215,016

- Home value in 2022: $244,451

- Home value in 2023: $261,859

- Home value in 2024: $291,301

- Home value in 2025: $316,160

Athol leads Massachusetts with an extraordinary 143.7% appreciation that has transformed $129,740 investments into $316,160 assets, generating $186,420 in equity—remarkable wealth creation in the state’s fastest-growing market. The impressive 75.4% surge since 2020 demonstrates accelerating recognition of this north-central Massachusetts town amid shifting housing preferences and remote work flexibility. Despite posting the state’s highest appreciation rate, Athol remains one of Massachusetts’ most affordable markets, suggesting continued upside potential. The town’s manufacturing heritage, outdoor recreation access, and relative affordability create sustainable demand fundamentals. Recent price trajectory confirms Athol’s transition from overlooked to high-growth market status.